Nature Investors

From portfolio design to project management, Nusanterra empowers carbon investors to confidently make a positive impact. We help you define clear investment strategies, source exclusive deals through our trusted network, and mitigate risks through extensive due diligence and pre-investment funding.

Our expertise ensures projects deliver not just carbon credits, but also verified biodiversity and community benefits, maximising your positive impact.

"We believe that the Voluntary Carbon Market can serve as an important lever in realising Malaysia's net-zero emissions aspiration, as well as supporting the private sector's voluntary climate commitments and decarbonisation journey."

Muhamad Umar Swift Bursa Malaysia Chief Executive

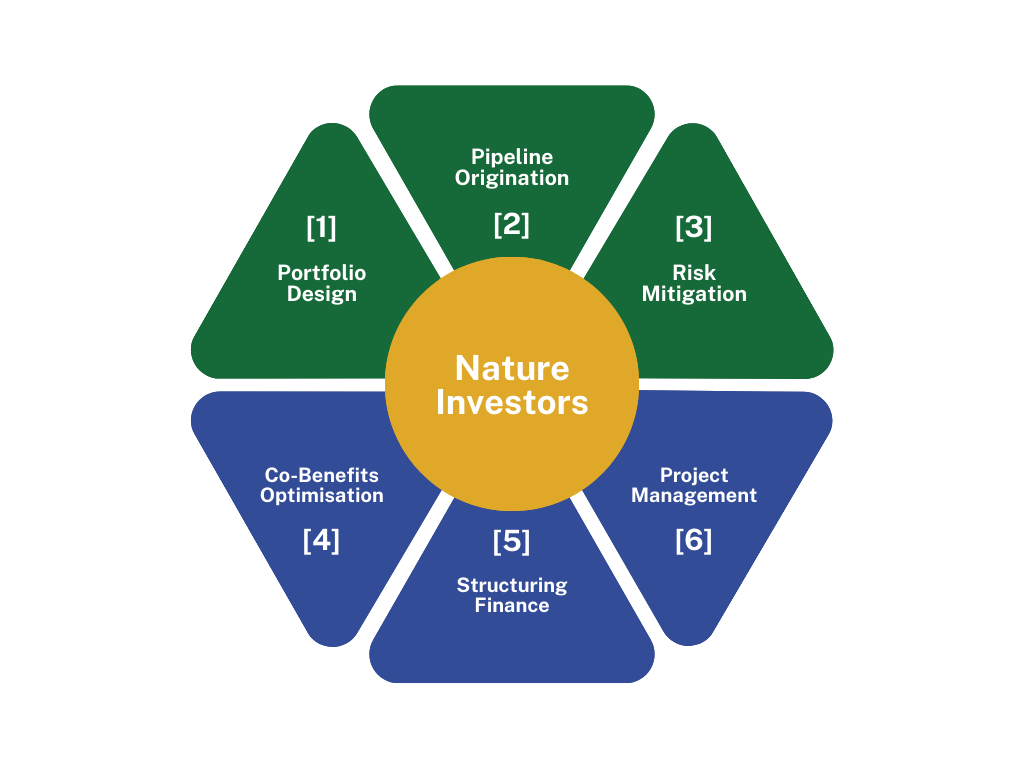

How we work with Nature Investors

1. Portfolio Design

We provide advisory support to investors in defining investment criteria and processes based on lessons learnt from the market. We will create your customised climate investment plan, in line with your company values and budget. We provide you with solutions for managing your carbon portfolio and analysing your project’s impact over time.

2. Pipeline Origination

We source and consolidate volumes from project developers and governments, many through long-term trusted relationships. Our team sources & carries out due diligence to find projects that offer the highest integrity. Our consortium consists of technicians and the most reputable organisations in conservation.

3. Risk Mitigation

We serve as the “architect of the deal” presenting packaged deals to investors that identify project risks and mitigants through extensive project due diligence. We offer further project de-risking by setting up a pool of flexible capital to fund proof-of-concept activities before investment confirmation. All our projects are certified by the highest standards to ensure your contribution creates real-world impact.

4. Co-Benefits Optimisation

We support project design and execution to ensure verifiable carbon, biodiversity, and community benefits by bringing in regionally specific expertise in targeted NBS activities. Invest in your very own high-quality conservation projects from inception, secure credits to reach Net Zero, and make a real impact on communities and ecosystems for generations to come.

5. Structuring Finance

We create financial models that demonstrate projects meet predefined investor metrics (IRR, etc.) and set up SPVs to implement and operate the project to ensure effective delivery of project milestones. We offer fair and transparent prices that ensure that a majority of your investments go directly into creating impact. Invest in your best-in-class project, locking in credits at a fixed rate for decades to come.

6. Project Management

We support project execution by working within in-country Special Purpose Vehicles (SPV) and Public-Private Partnerships alongside local implementation partners and governments. We build capacity at the implementation level for effective project management while eliminating low-value intermediaries and shrinking the carbon supply chain.

Assess Land

Mixed planting systems like agroforestry have much higher carbon capture levels than mono-crop systems. Agroforestry practices are therefore an effective tool in the fight against climate change and the protection of food supply in the Malay Archipelago.

We collect and analyse GIS data in order to determine its carbon removal potential. We use satellite imagery and deep learning models to precisely estimate the carbon baseline and expected additionality. By identifying links to High Conservation Value areas, we help increase the value and quality of projects.

Nusanterra draws on regenerative methodologies to design projects with measurable impacts in terms of improved soils, water cycles, biodiversity, ecosystem health, and carbon cycles.

Finance Plan

We connect landowners with corporates willing to provide interim finance for the development of carbon projects through forward purchase agreements. On credit issuance, the buyer gets a guaranteed amount of credits at a pre-determined price from the project.

By cutting out the need for intermediaries to facilitate the sale of carbon credits, Nusanterra aims to maximise revenue for conservation activities in high-quality projects.

The Carbon Prospector Network (CPN) creates a community of smallholders that can share the costs of certification costs via special purpose vehicles to finance the upfront project development costs.

Certify Project

We provide support throughout the project cycle to achieve measurable local impact that meets international best practice standards whether Verra, PlanVivo or Gold Standard.

Our Nature-Based Solutions apply interdisciplinary approaches that address natural resource management challenges including afforestation, biodiversity conservation, sustainable livelihoods, and ecosystem regeneration.

Our teams on the ground bring decades of experience and deep connections with the land and local communities. By working with partners who are deeply embedded in local communities, we create trust and build projects that have real, lasting impact for generations to come.

Sell Credits

Digitalised workflows and precision forestry solutions can dramatically decrease time and increase data integrity of Monitoring, Reporting, and Verification (MRV) processes while bringing all the rigour of traditional methods at a fraction of the cost.

We support landowners with digital MRV (D-MRV) solutions to manage projects, monitor the evolution of carbon stocks and take control of the sales process.

Advisory Services

CARBON REVENUE ASSESSMENT Understand your revenue potential from existing and potential carbon stocks

CARBON PROJECT DESIGN Maximise your environmental sustainability impact and leave an impactful legacy behind

PROJECT MANAGEMENT Simplify your life and leave the stakeholder management and reporting to Nusanterra

FAQs

Afforestation is a process of planting trees on land that has not been recently forested. Nusanterra offers landowners the opportunity to earn carbon revenue through our Afforestation projects and uses Verra’s afforestation, restoration and revegetation methodology for carbon removal verification.

A carbon credit is a certificate that can be bought with the purpose of offsetting greenhouse gas emissions. One credit usually represents one tonne of carbon dioxide equivalent (CO2e) avoided or removed from the atmosphere.

VCUs (Verified Carbon Units) are one type of carbon credit and one VCU represents a reduction or removal of one tonne of carbon dioxide equivalent (CO2e) achieved by a Verra project as part of their Verified Carbon Standard (VCS) program.

The exact income will depend on the type of trees planted, land quality, project length, etc. As an example, an afforestation project on high-quality land in XXX is expected to generate approximately XXX VCUs / Ha over a 50-year contract. If VCU prices are at XXX MYR, an afforestation project may generate around XXX MYR / Ha.

This is an estimated income and depends on specific conditions as well as the carbon credit price at the time of sale. Your lands’ potential income is calculated in a Carbon Revenue Opportunity Assessment.

Afforestation and Impact Forestry both include grouped projects, which involve multiple landowners. Grouped projects save landowners money because they generate monitoring and verification efficiencies. Grouped projects have a much lower unit cost base than single landowner projects and can also generate larger volumes of carbon credits, which offers sales and marketing advantages. Carbon credit buyers often want to buy large volumes of specific carbon credits (e.g. carbon credits from afforestation) from a single vintage (i.e. produced in a specific year).

Nusanterra will group landowners based on their regional risk profile and management objectives (e.g. managing forests for timber versus managing forests for conservation). Members of a grouped project are likely to come from a similar region (e.g. Baltic states) and manage forests in a similar way.

Nusanterra will develop and manage carbon monitoring and verification for each grouped project. The monitoring and verification activities of each group member will be synchronised to meet the reporting requirements of Verra (see What is Verra?). However, Nusanterra will not operate our grouped projects as a single carbon pool or as a cooperative. Nusanterra will monitor the performance of each group member and as far as possible, distribute carbon payments based on the performance of individual group members. Group members will not receive an average share of each grouped project.

Nusanterra arranges for and covers the costs of the Verra certification and validation process (usually undertaken by a third-party Verra partner).

However, as a landowner, you are required to share monitoring data (e.g whether you’ve harvested any timber, any fire or pest impacts etc) with us every 5 years (more frequently if you’ve opted into annual cash payments), throughout the length of the contract. The monitoring is needed to pass verification, which enables landowners to maximise carbon revenues. Where-ever possible, we use data you are already gathering for government reporting etc, but at times this may require additional data gathering from you.

We are also continuously working on automating the process and using remote sensing technologies such as satellite imagery combined with AI-based analysis in order to reduce the monitoring burden on landowners.