Week 16: Conservation Finance News

Sarawak law to be used as a reference in enacting federal carbon trading law

Sarawak Premier Tan Sri Abang Johari Openg announced that the state’s carbon trading law would inform a forthcoming federal law on carbon trading. The federal government has agreed to incorporate Sarawak’s legislation, and officers will study the state law to include it in federal legislation. To know more, click here.

The social cost of carbon at US$225/tonne - implications for Asia

Economist Michael Greenstone, who first established a price on emissions for the US government, emphasizes accurate energy pricing to reflect true costs, calls for emissions cuts in OECD countries, supports green energy subsidies, and advocates for updated economic models to address climate challenges. Click here to learn more.

Study reveals growing connection between carbon credits and biodiversity criteria

Two-thirds of carbon credits from restoration projects are linked to biodiversity-positive methodologies, with 67% issued for projects with biodiversity requirements. Despite this, UN CDM standards have not prioritized nature requirements, as per a study by AlliedOffsets analyzing 64 methodologies and 6,000 projects generating 380 million credits globally. Click here to learn more.

CDC Biodiversite to launch free footprinting tool

French data company CDC Biodiversite is set to release a free version of its Global Biodiversity Score (GBS), a biodiversity footprinting tool, with limited features this week. This "huge step" aims to increase visibility for users, especially given the emerging standards frameworks. The free tool will be available on GitHub for self-assessing companies and researchers, although without technical support. To know more, you can click here.

Limited corporate demand restrains nature credit market as carbon developers wait

Voluntary nature credit suppliers are considering various strategies to increase companies' interest in units, such as simplifying purchases and organising awareness-raising events. Despite heightened attention on the voluntary biodiversity credit market after the 2022 Kunming-Montreal Global Biodiversity Framework (GBF), many companies remain hesitant to turn their interest into transactions. Click here to know more.

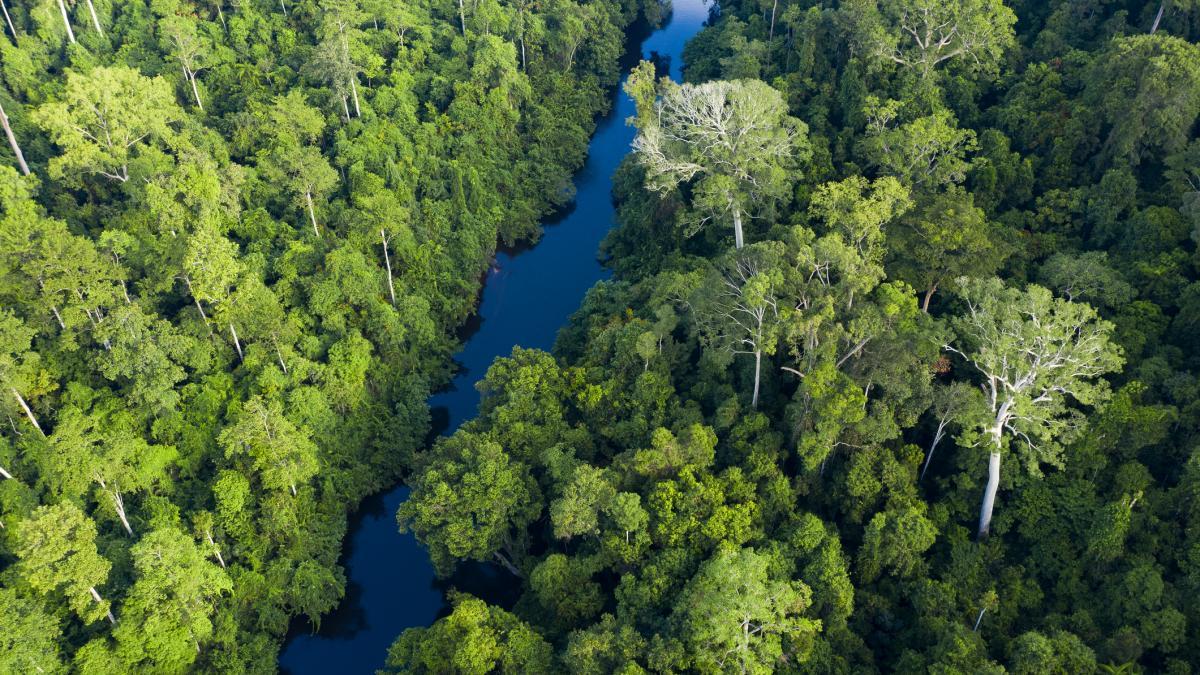

Malaysia's first local nature-based carbon credit available by Q1 2024

Malaysia's first local nature-based carbon credit, Verified Carbon Units (VCUs) from the Kuamut Rainforest Conservation Project, will be available at the Bursa Carbon Exchange (BCX) in the first half of 2024 for Malaysian buyers. The project covers 83,381 hectares of tropical rainforests in Tongod and Kinabatangan, over 260km southeast of Kota Kinabalu, including previously logged-over areas. Supported by various organizations, the project aims to reduce emissions by 543,049 tonnes of carbon dioxide equivalent per year over its 30-year lifespan. To learn more, click here.

Biodiversity Credits: Another Business-As-Usual Finance Scheme?

Voluntary biodiversity credits are a new finance scheme supporting biodiversity conservation. However, Indigenous and environmental groups are concerned that, like the voluntary carbon credit market, these credits may end up as offsets, enabling companies and governments to maintain the status quo. Critics also point out the lack of a clear demand from the private sector and the challenges of making the voluntary biodiversity credit market sustainable on a global scale. Click here to know more.

Urgent need for sustainable financing in tiger landscapes

Sustainable financing for conservation areas means making investment decisions with environmental and social impacts in mind. For tiger habitats, this involves substantial, long-term investments in tiger conservation by both public and private sectors, supporting specific conservation goals. To know more, you can click here.

Funding for Indigenous Peoples and local communities rises 36%

Donor funding for the tenure and forest guardianship by Indigenous Peoples, Afro-descendant Peoples, and local communities has increased by a third over the last eight years. However, the report found that few resources have directly reached ground-level organisations. Between 2020 and 2023, annual payments worldwide averaged $517 million, a 36% growth from the previous four-year period, according to an analysis published by NGOs Rainforest Foundation Norway (RFN) and Rights and Resources Initiative. Click here to know more.

Majority of Asian investors lack deforestation policies

AIGCC finds a gap in deforestation strategies among Asian investors, with only 4% conducting detailed assessments and 90% lacking a policy. Asset managers are more proactive. Despite the need for $71 trillion in investments for net-zero by 2050, most investors are not ready to mobilize financing. Key priorities include carbon pricing, climate technologies, and sector pathways. However, investors are hesitant to push for ambitious climate policies. Climate Action 100+ sees exits from major asset managers, indicating challenges in ESG adoption. To know more, you can click here.